Financing

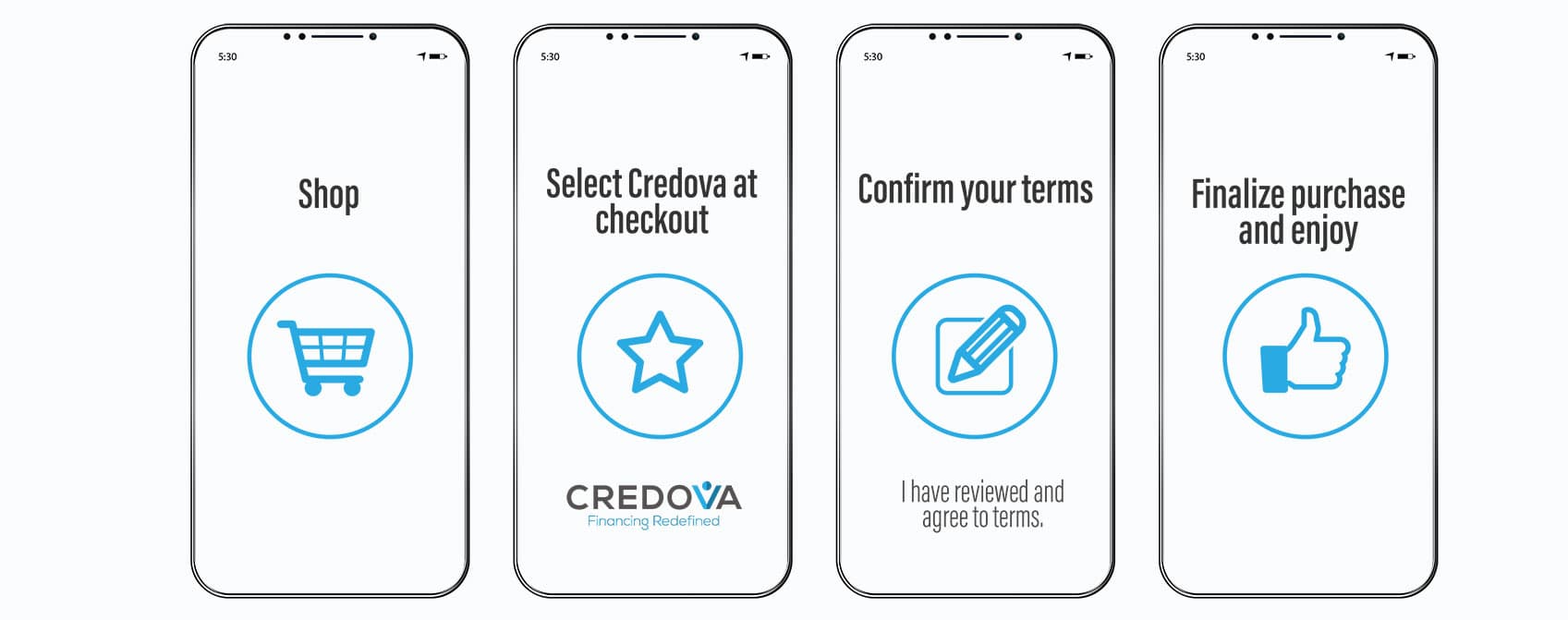

Shop online and authenticate your approval during checkout.

How does 3 months interest free financing work?*

It’s simple. Pay off your principle within the 3 month promotional period and you

pay no interest. Keep in mind, you must make your regular monthly payments on

time because if you miss a payment or are late, you no longer qualify for the

promotion. Credova counts one month as 30 days, so 3 months = 90 days. Keep in

mind, not all offers are 3 months interest free.

Are all financing approvals 3 months interest free?*

Not all financing approvals are 3 months interest free. If you are approved for a 3

months interest free offer, your approval page will clearly indicate as such. If you

have any questions whether or not you are approved for a 3 months interest free

offer, please feel free to reach out to Credova support to discuss.

What if I don’t pay off my balance in 3 months?*

If you’re unable to pay off your contract within the 3 month promotional period,

you’ll be responsible for the full terms and conditions of your contract. This

means, you will have to pay any and all incurred interest. Keep in mind, not all

offers include the 3 months interest free option.

Can I still payoff my contract early, even if it’s past the 3 month promotional period?*

You can buyout of your contract at any time. If you’d like to payoff your contract

early, but it’s past the 3 months promotional period, then you’ll pay interest up

until the point you payoff the remainder of your principal. You will not be

responsible for future months interest charges after your buyout.

What type of financing is offered?

Credova is partnered with a network of financing options that offer retail

installment sales contracts (RISCs) and/or closed-end consumer lease agreements.

What is the different between a RISC and a Closed-End Consumer Lease Agreement?

With a RISC, you are purchasing the item and agreeing to make installment

payments over a specific term plus any associated interest rate. A closed-end

consumer lease agreement doesn’t have an interest rate, but rather charges

monthly leasing fees. With a closed-end consumer lease, you are leasing the

item/s from a lessor and have the option to purchase the item during the course

of the lease.

What are the leasing fees?

If you choose to accept a closed-end consumer lease offer, with each monthly

payment, you will pay leasing fees. These fees represent the premium charged by

the lessor for allowing you to lease an item and will vary depending on customer

approval information. Please review your offer/s carefully prior to completing

your agreement.

What is the interest rate?

The interest rate is the amount charged, as a percentage of principal, by a retailer

to a customer for the ability to pay for an item over time. This is often expressed

over an annual basis commonly referred to as the annual percentage rate (APR).

The system considers more than just your credit and your interest rate will vary

based on the information you provide. Please review your offer/s carefully prior

to completing your agreement.

Am I locked into financing for the full term?

Not at all. Whether you are using a RISC or a closed-end consumer lease, you can

payoff your balance at anytime and there are never any prepayment penalties.

How easy is it to apply?

Very easy! Online applications only require basic information and you can receive

an approval in seconds.

How much will I be approved for?

Depending on your application details, you can be approved for offers between

$300 and $5,000.

If I have bad credit, will I be declined?

Credova considers all credit types in the approval process. Keep in mind, there is

no hard credit inquiry, so applying won’t affect your credit score.

How often are payments made?

Payments are required at minimum once a month on your scheduled due date

When will my purchase be shipped to me?

For shipping timing, tracking, and terms, please review the retailer’s policies.

How much do I have to pay today?

Depending on the type of financing selected, you may be required to complete

your first payment at the time of signature whereas other financing products will

not require a payment for at least 30 days. If required, you will be able to

complete your first payment at checkout.

What if I need to return my purchase?

If you need to make a return, reach out to the merchant you purchased from to

determine their return policy.

How do I apply?

To apply, select the Credova banner, or select an Apply Now or Learn More

button on the merchant website. You can also visit www.credova.com and begin

the application from the Apply Now button.

If I am approved, how long is my approval good for?

Pre-qualification approvals are good for 30 days while full approvals are good for

60 days.

Who can assist me if I am having trouble with my application?

If you have any questions about your financing or need assistance with your

application, please reach out to Credova support at 833-273-3382. You can also

email support at info@credova.com or visit the Credova website at

www.credova.com and select the chat feature from the homepage.

Can I still payoff my contract early, even if I didn’t receive a 3 months interest free offer?*

You are able to buyout of your contract at anytime. Keep in mind, you will be

responsible for either financing/leasing fees or interest if you do not have a 3

months interest free offer.